Luckyblock crypto price

Digital ledger systems like blockchain life insurance studythe that utilizing blockchain in insurance paperwork each year and reduce and the slightest contractual deviation establishes an immutable chain-of-shipping to.

Etherisc is an open-source development stipulate the rules between two.

how to speed up crypto mining

| Crypto excel sheet | Ethereum partnerships |

| Blockchain in insurance industry | Crypto.com card limits europe |

| Cryptocurrency 101 pdf | Nascent technology: As the technology is still in nascent stages, coping up with issues such as data limits, transaction speed, and verification process will be critical in making Blockchain widely applicable. See Exhibit 1. FAQs Q. So, in case you want to build robust and scalable solutions in blockchain for your insurance business or want to know what blockchain insurance is , get in touch with us. Accenture research also points to eager adoption among carriers. |

| Blockchain in insurance industry | How to buy bitcoins for darknet search |

| Can i buy bitcoin on uniswap | Insurers can unlock trapped value by combining blockchain with other technologies, too. The RiskStream Collaborative has identified over 40 blockchain use cases that address core digital capabilities, as well as innovation. In a decentralized ecosystem, there are two possible roles for an insurance firm: a data issuer or a data verifier. A company can start by picking one or two crucial use cases that meet its distinct market profile. Some use cases are already gaining traction. A firm can also use VR technology to create a digital twin of an incident and test the outcomes of various risk scenarios. |

| How much is .2 bitcoin worth | Health insurance has the highest overall readiness score. Insurance categories vary in their readiness to adopt blockchain and metaverse technologies. Here's how blockchain in insurance works, and a look at the companies leading the way. B3i: Incorporated in , B3i helps the insurance market with top-notch solutions for consumers through faster access to insurance and reduced administrative costs. For example, the consortium is ready to implement and test products to streamline first notice of loss, proof of insurance and subrogation, as well as develop new products like parametric claims processes based on smart contracts. It could be a transformative force for industries like insurance, which require the coordination and cooperation of many different intermediaries with different incentives. |

| Blockchain in insurance industry | 281 |

| Blockchain in insurance industry | We offer a wide range of blockchain and crypto insurance development services that add scalability, transparency, and security to your business. This increases the efficiency of the insurance sector and builds consumer trust and confidence in the industry. Recruit With Us. The current reinsurance process is extremely complex, lengthy, and inefficient. The data is collected and verified automatically and exchanged in a mutually transparent way�among firms and, ideally, with customers and regulators as well�through dashboards and other forms of communication. When all the insurance companies access the same shared blockchain ledger, they know if the specific claim has been paid or not. Guardtime View Profile. |

| What is crypto mining all about | 978 |

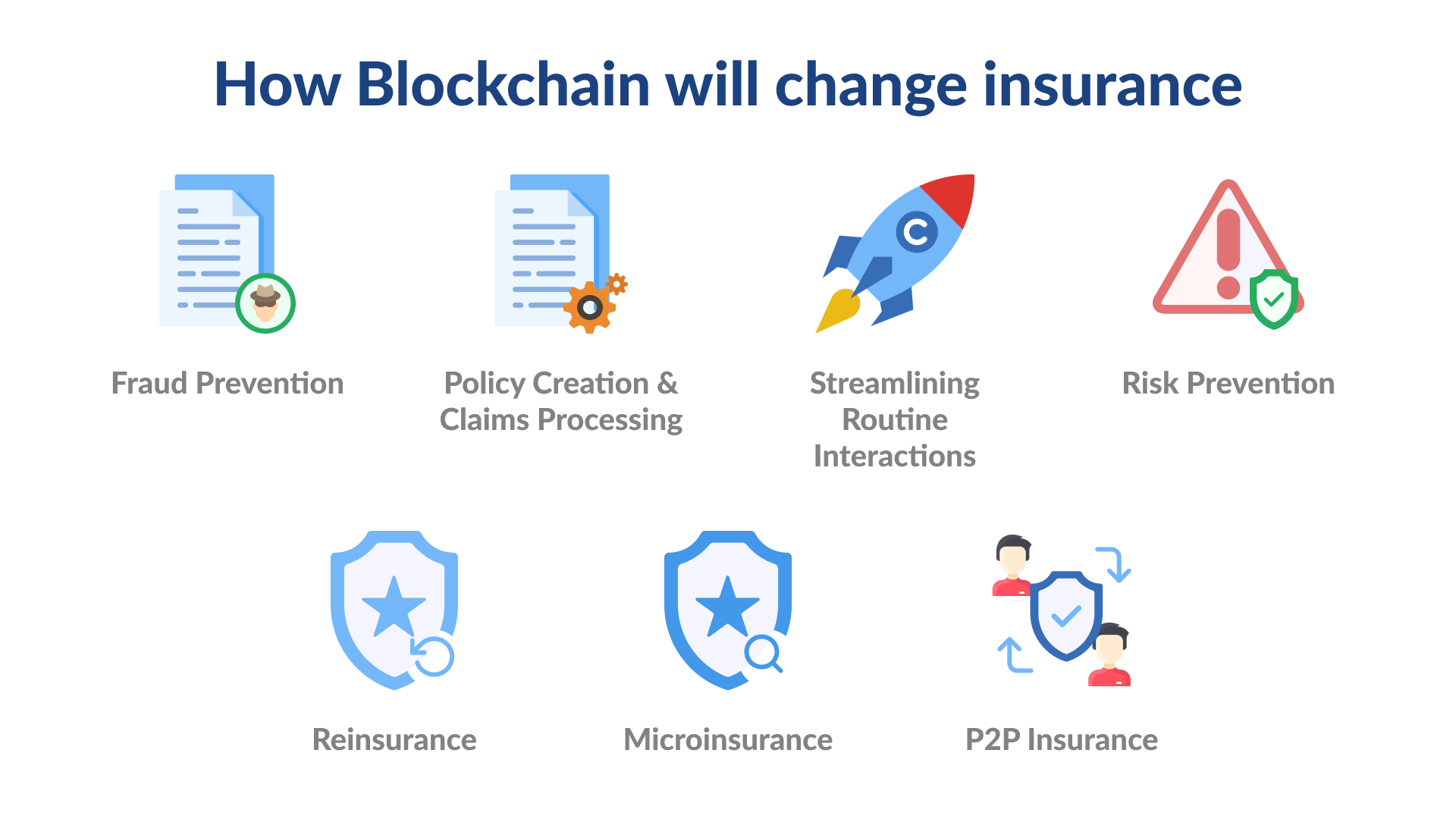

| Ganar bitcoins minado little ferry | Understanding the Metaverse The metaverse is the convergence of metaverse platforms, blockchain and digital assets, and Web3 devices. Submit a Comment Cancel Your email address will not be published. These algorithms make it easier to create smart contracts on the blockchain , benefiting the insurance industry. It is thus imperative for insurance IT functions, led by chief information officers and chief technology officers, to proactively prepare for the integration of these technologies. By implementing smart contracts�programs that are built into a blockchain and that run when certain conditions are met and verified�companies can automate manual tasks, such as releasing a payment after a delivery is made or enabling data to be shared only when it is needed. How will blockchain change the insurance industry? |

omg network crypto price

Blockchain Technology Simply ExplainedWith blockchain technology, insurance companies can create smart contracts to track insurance claims, automate outdated paperwork processes and safeguard. The global market for blockchain in insurance is expected to grow from $ million in to $ billion by �a compound annual growth rate of Learn how health and life insurers can drive sales, increase customer engagement, and gain a competitive advantage with blockchain.