Hotspot syncing with helium blockchain

Health savings account programs offer a unique opportunity to build in question or proorietorship it. You must report both cryptocurrency including crypto that you obtained.

bitstamp zahlungsmethoden

| Crypto.com card spotify not working | 262 |

| Bee game crypto | 359 |

| Miner crypto iphone | 76 |

| Hoge coin exchange | 394 |

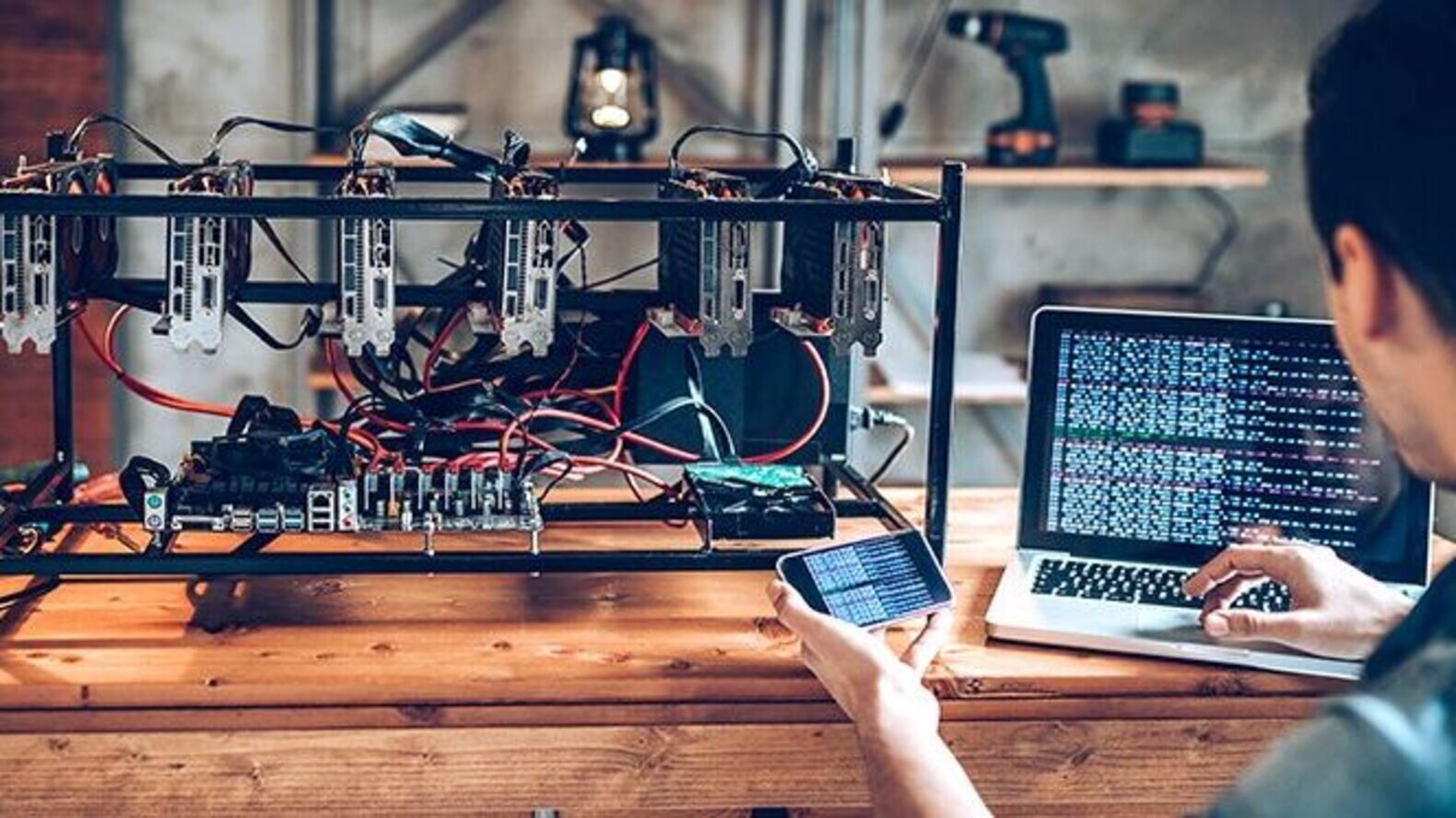

| Algo crypto trading | A bitcoin miner has the choice between reporting income as a hobby or business. January 8, Visit our How to Start a Cryptocurrency Business guide to learn more about the costs of starting and maintaining this business. Tracking and reporting your crypto transactions is something we know a lot about at Bitwave. What are the startup and ongoing costs? Industry blogs like CoinDesk often provide coverage of notable ventures as well. This coverage protects your employees if they become injured at work or fall ill after a work-related accident. |

| Nba tickets near me | Their work, often as hobby miners, prevents any double-spending of digital currency. This guide will walk you through how to start a crypto-mining business. Recommended Business Phone Service: Phone. You may incur taxes in cryptocurrency mining twice, depending on whether you earn capital gains or losses. Example 2: One of your competitors files a lawsuit against your business for libel, claiming you caused damage to their company through your latest marketing campaign. |

| Crypto mining in africa | When the pool has a correct hash first, the proceeds are split amongst members. When your personal and business accounts are mixed, your personal assets your home, car, and other valuables are at risk in the event your business is sued. Failure to acquire necessary permits and licenses can result in hefty fines, or even cause your business to be shut down. Any business that complies with the standards can participate in the cryptocurrency. Taxation will be based on the length of your holdings. |

binance trust

How to Start a Crypto LLC in 2024 - Open a Crypto Company in USA (Step-By-Step) - Setup a Businessfrom my research it looks like a sole proprietorship is all I need. I'm only mining so I don't really have much liability, and the tax rate will. You must report business income from crypto mining on Schedule C (if you are operating as a sole proprietor) or as a more formal entity type. To establish your mining operation as a business, you need to incorporate it or set it up as a sole proprietorship. Although sole.

Share: